Risk management

Empresa: Gol Linhas Aéreas

Setor: Aviation

Projeto: Managing Risk amid External Market Variables

By Richard Lark, EVP and Chief Financial Officer, GOL Linhas Aéreas Inteligentes (GOL)

GOL Linhas Aéreas Inteligentes (GOL) is one of the largest airlines in South America, with a fleet of 110 aircraft, annual revenues of over US$2.5 billion and over 700 daily flights to 60 destinations. The airline was founded in 2001, and went public in 2004, issuing shares simultaneously on both the São Paulo Stock Exchange and the NYSE.

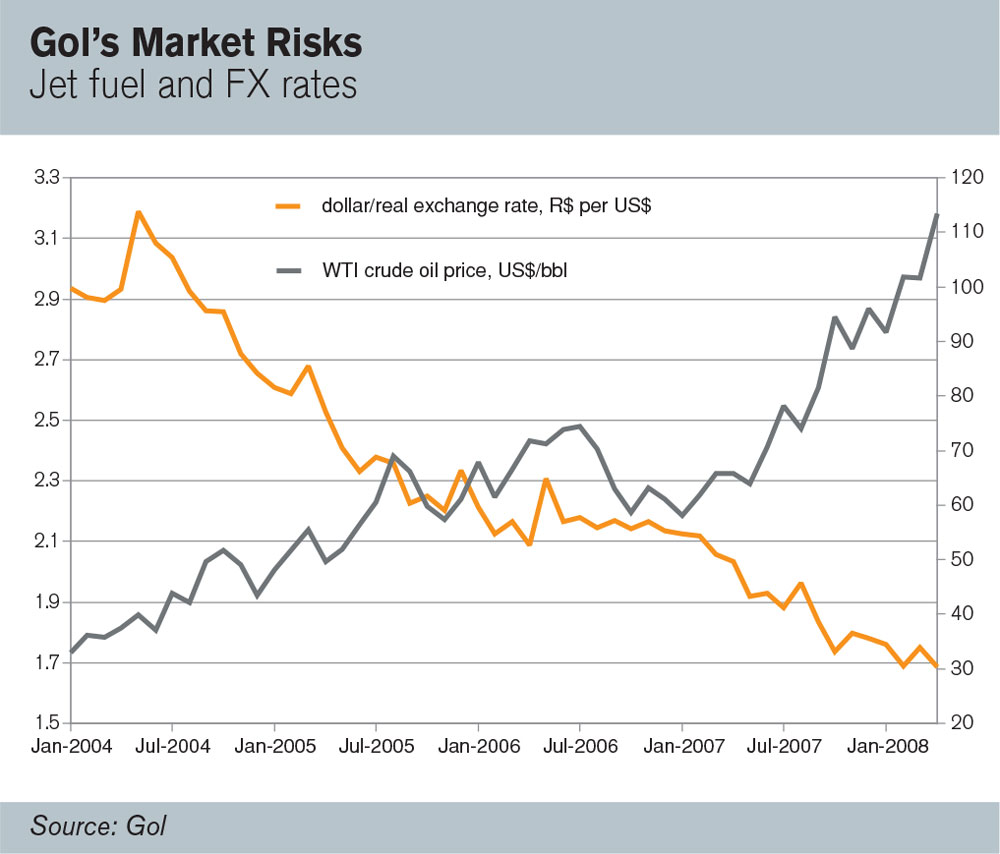

GOL initiated its risk management strategy and program in 2003, creating policies and procedures to assess, manage and control market risks. GOL is exposed to different types of market risks, including volatile jet fuel prices and exposure to FX and interest rate fluctuations. Each month, its operation consumes 125 million liters of jet fuel, whose market price depends on exchange rates and volatile international energy prices. While GOL sells tickets in Brazilian Reais, it pays for aircraft leases, insurance, maintenance, and aircraft acquisition costs in US dollars. The company also finances its aircraft acquisitions with floating rate instruments, and is exposed to fluctuations in dollar interest rates.

In the last four years, these risks were manifest and the company’s risk management strategy and program were tested as the dollar fell 40% against the Real; crude oil prices rose 220%; and interest rates ranged between 1.17% and 5.59%.

RISK MANAGEMENT PRINCIPLES AND OBJECTIVES

Risk management increases shareholder value by avoiding excessive earnings volatility, preventing distress costs, increasing cash flow predictability, and lowering the cost of debt by reducing default risk to debt-holders. It also avoids having to manage short-term price impacts and allows the company to focus on its core activities. Several studies show that shares of companies with risk management activities trade at a premium over those of comparables without them.

The value of risk management to an individual company is a direct function of the volatility of the price environment in which it operates. GOL conducted a company-wide risk assessment to assess the size of the opportunity presented by strategic risk management. The assessment confirmed that the focus should be on risks arising from the variability of FX rates, jet fuel prices, and interest rates. It also provided guidelines for structuring risk management functions and the use of derivative instruments to implement risk management actions. These guidelines translated into a set of risk management principles including the establishment of a written risk management policy and of independent control and management functions for risk, the establishment of limits for certain exposures as well as the definition of key risk indicators to serve as early warning signals.

GOL’s risk assessment also defined its risk management objectives. GOL determined that the Brazilian airline industry had the ability to pass on cost increases over a moderate period of time. It also detected that jet fuel prices, as a function of the demand for energy, are correlated with economic growth and therefore provide a degree of natural hedge in GOL’s operations; but that there is enough excess short-termmarket price volatility to hurt operating margins over shorter time horizons.

As the possibilities of risk mitigation through diversification or through passing cost increases on to customers are limited, the company started very early to use derivative instruments to hedge its exposure to market variables.

RISK MANAGEMENT STRATEGY

The first step towards integrating market risk into the strategy of the company was to define what types of impacts should be prioritized. The primary concern was identified as excessive earnings volatility caused by fluctuations in dollar exchange rates and jet fuel prices before cost changes could be passed on to ticket prices. As a nascent company with an aggressive growth plan, GOL was also concerned about the availability of liquidity resources under market risk (how much changes in market FX rates would impact the value of future cash flows projected for aircraft acquisition, and to what extent changes in future cash flows could impair its growth plan). Risk mitigation alternatives were then raised and evaluated.

The use of derivatives to mitigate these market exposures at GOL is centered on a hedging program. This program defines the strategies to be pursued, the derivatives that are allowed, and disciplines how to address the questions of how much, how long, and when to hedge.

RISK MANAGEMENT POLICY

The first step in the hedging program was to design a Risk Management Policy. Under this policy, an internal decision-making structure was created to discuss the size, instrument and tenor of hedge transactions, to execute the hedge transactions, and to control them, assuring that they comply with the policy rules. The policy created a long-term risk management commitment that survives temporary losses on any hedge portfolio. In the case of fuel hedges, this long term commitment proved a success: the big rewards from hedging jet fuel were in 2006 and 2007 by when the company was seasoned enough in risk management to support sizable derivatives positions.

The Risk Management Policy also sets limits to the size and type of hedge transactions and sets the basic controls to be applied to derivatives including, for instance, forbidding option writing, except as part of option collars and ruling Source: Gol out exotic derivatives, such as barrier options or range accrual notes. Average price options, however, are accepted as valid hedge instruments.

The policy also sets adequate metrics to assess the size of an exposure. Each metric is used for a different purpose: Cash Flow@ Risk is employed to measure the liquidity, covenant and solvency risks; Value @ Risk is employed mainly in cases of exposure to present value of assets and liabilities, as pre-payment options and options to modify lease agreements; and EBITDA @ Risk and EBITDAR @ Risk are used to measure the economic impact of market variables.

HEDGING OPERATIONS

The Risk Books

GOL organized its exposures into three main risk books that capture different types of impacts:

- The Current Expenses Book holds the company’s operations’ economic exposures to jet fuel prices and dollar exchange rates. The objective is to minimize earnings volatility caused by these two variables.

- The Medium Term Obligations Book holds cash flow exposures to the dollar. The objective is to minimize the probability of financial distress caused by FX rate movements.

- The Interest Rates Book holds the company’s economic exposures to international floating interest rates. The objective is to limit the potential increase in future expenses caused by a rise in interest rates.

Each book has specific strategies, permitted instruments, and limits. The execution of hedge transactions is decided for each book separately. The effect of risk management actions is consolidated across the books with a set of firm-wide “@ risk” metrics and compliance with overall policy limits is ensured.

Jet Fuel Hedging

At almost 40% of the total, jet fuel cost is the single largest component of expenses. After studying how the price of the jet fuel purchased in Brazil behaved in comparison to the main benchmark energy derivatives, GOL selected WTI and heating oil swaps and options for its hedging activities. The superior liquidity of WTI contracts makes them a more cost-effective choice than jet fuel derivatives, though the hedge-effectiveness of WTI is not as good as that of jet fuel.

When Hurricane Katrina hit Gulf Coast refineries in 2005, causing the cost of refined products to soar, the use of WTI as a hedge instrument showed limitations. However, for most of the last four years the WTI hedge, adjusted for the correct proxy ratios, has been highly effective. GOL carried out a thorough statistical analysis to validate that WTI could be used as a good proxy of Brazilian jet fuel. It had to disregard widespread multivariate conditional returns models, inherited from the prices of financial assets, and replace them with co-integration models that could better explain commodity price co-movements.

The amounts and tenors most appropriate for jet fuel hedges were initially set considering GOL’s ability to pass cost increases forward to airline tickets. After some time, GOL’s pricing strategy changed, and hedges were extended accordingly. Until recently, GOL hedged variable ratios of the next 18 months’ forward consumption. Today, the size and tenor of GOL’s fuel hedge varies with its appraisal of probable future prices, and with its own pricing policy. To manage the downside risk, options and zero-cost collars are used.

FX Hedging

GOL’s operations are exposed to changes in the Real-Dollar FX rate due to lease, maintenance, insurance and booking system costs. Although the airline pays for jet fuel purchases in Brazilian Reais, the local price of jet fuel is also linked to the FX rate. To hedge this FX exposure, GOL uses exchange-traded Dollar-Real futures and options.

One key aspect of hedging the dollar-real exchange rate is the large forward basis incurred, which is a consequence of the large interest rate differential between the two currencies. Currently, the local carrying cost of dollars against Reais is around 8% per year. This imposes high hedging costs for firms seeking to protect themselves against a real devaluation. FX hedging decisions take into account such costs, and rely largely on options to mitigate them. This results in the possibility that, for a given period of time, the hedge amount of the international WTI price embedded in the jet fuel exposure may differ from the hedge amount of the FX rate exposure embedded in local jet fuel pricing.

INTEREST RATE HEDGING

Interest rate exposure is measured in “basis point value”, meaning the present value of the increases in future interest expenses due to a 0.01% parallel increase in interest rates. GOL uses interest rate swaps and swap locks to hedge interest rate exposure in a transaction basis.

COMPLIANCE AND CONTROL

Controlling derivatives positions is a critical aspect of any hedge program. Many hedge initiatives suffer a loss of confidence – possibly leading to discontinuation – if the company has to meet unexpected margin calls or mark-to-market revaluations. At GOL, derivatives were marked to market from the first transaction. GOL has the ability to mark its derivatives portfolio to market every day, and the value of assets or liabilities represented by its derivatives are always known.

To comply with SFAS 133 and the requirements of section 404 of the Sarbanes-Oxley Law of 2002, GOL created a set of controls that ensure that all components of financial information regarding its derivatives positions are properly accounted. These controls span over transaction capture and documentation, position recordkeeping, instrument valuation, hedge effectiveness assessment and measurement, derivatives and hedge accounting, and financial data flow to financial statements.

ACCOUNTING AND DISCLOSURE

An important aspect of GOL’s hedge program is its disclosure to investors. Investors in airline stocks know that the value of their investments may decline if fuel costs rise, but they lack the means to predict exactly how, and to what extent. In cases like these, the company’s management acts in the best interest of shareholders by reducing earnings volatility through hedges, provided that it keeps investors informed about its risk management decisions.

Disclosure of hedge activities is an important part of GOL’s hedging program. It adhered to SFAS 133 rules of hedge accounting early in 2005, and extended them to financial reporting to Brazilian investors. The designation of GOL’s derivatives as hedge instruments for accounting and disclosure purposes allows the airline to match the timing of the gain or loss in the derivatives with that of the recognition of the respective expense. To qualify for hedge accounting, a derivative must be linked to a specific exposure and pass a number of tests, practically ruling out any chance of speculation. The use of hedge accounting made hedge effectiveness a core concern, since hedge accounting can only be applied to highly effective hedges.

ORGANIZATIONAL AND GOVERNANCE FRAMEWORK

The market risk management function at GOL is carried out at the governance level by a senior Risk Policies Committee (RPC) that determines the company’s risk appetite. It does so through an evaluation of probable impacts of market variables on earnings and cash flow.

The RPC meets quarterly and is composed of one board member, an independent expert and the CFO. It is responsible for analyzing market price movements and income statement impacts. It also evaluates the last quarter’s hedging policy effectiveness, and decides whether to keep or change the current hedging policy into the next quarter.

At the executive level, a Risk Management Committee meets weekly and is responsible for determining the actions needed to execute derivatives transactions according to pre-approved strategies.

CONCLUSION

Strategic risk management represents a tremendous opportunity for a company to set itself ahead of the competition by reducing the risk that it represents for stakeholders and placing itself as the premier choice for suppliers, employees, financing providers, and business partners. For GOL, risk management is a key aspect of corporate governance.

To perform risk management, derivatives instruments are often needed as tools for risk transfer. However, derivatives are relatively new instruments, and adequate procedures must be put in place to control them. Strong discipline and regard for the principles that direct risk management are keys for ensuring the right use of derivatives and the success of any risk management program.